Bad Debt Lendings - What You Required To Know

Authored by-Schneider Williams

If you want cash to repay a few of your bills, you may take into consideration obtaining bad credit report car loans Not only are these lendings helpful in paying off your debts, but they won't harm your credit history. This makes them very appealing to many people.

Payday loans

Negative credit score loans are an excellent option for people who require to obtain money for a brief period of time. They are created to aid you leave monetary problem fast.

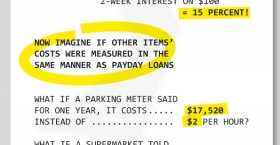

You can discover poor credit score loans online, or at your neighborhood bank. These are tiny, high-interest finances that commonly have a payment term of in between 2 and 4 weeks. The interest rates for these kinds of finances can be as high as 36%.

Prior to updated blog post decide on a payday loan, consider all the choices. Payday loan providers may not need a credit score check, and also you might be able to get the money in your bank account in as little as 24-hour. Nevertheless, there are extra fees to keep in mind.

One of the most effective ways to enhance your debt rating is to make prompt payments. Failure to pay back a funding can bring about late payment charges and also enhanced financial obligation. Taking the time to pay a funding on schedule reveals financial institutions that you have actually improved your debt management abilities.

Installment loans

The best poor credit score installment finances are ones that use very easy settlement terms, competitive APRs, as well as quickly financing. These lendings can assist you with any kind of kind of monetary requirement. They can likewise be utilized for major costs such as a residence remodel. Nevertheless, you need to select the ideal lender to ensure you obtain the right funding for your requirements.

So as to get authorized for an installation loan, you will certainly require to gather the appropriate information. This includes your federal government ID, Social Security number, and monetary details. You will additionally wish to find out if you get a lower interest rate.

A lot of installation fundings will certainly require you to settle your financing in month-to-month installations. Some loan providers may even permit you to automatically take out the funds from your account. Others might use you calendar pointers to ensure you never ever miss a payment.

Unprotected individual fundings

There are a variety of unsecured individual finances that you can secure if you have a bad credit history. These can be useful for various objectives. As an example, you can use these to settle debt, make home enhancements, and also spend for clinical bills.

When seeking an unsafe financing, it is necessary to contrast quotes from several lending institutions. Some may offer high APRs, and others may have a lot more rigid demands. You ought to also consider the costs charged by the lender. It's finest to deal with an economic expert to establish your alternatives as well as discover the very best deal.

Lots of trustworthy personal loan providers offer a little rate of interest reduction on auto-paying finance repayments. This can be very valuable to aid you stay clear of making late payments.

If you have a poor credit history, it can be difficult to obtain a loan. Guaranteed fundings, on the other hand, call for security, such as your residence. They can assist you qualify for a larger quantity of money and lower rates of interest.

They can assist you consolidate financial debt

Debt loan consolidation car loans can be a valuable way to settle high-interest debt. Nevertheless, you need to consider your alternatives before you make an application for one. There are a number of points to try to find in a bad credit rating financing, including the rates of interest.

A debt combination funding can assist you get a lower rates of interest, which can lower your monthly settlements as well as make it much easier to settle the financial debt. The lending additionally makes it possible to incorporate numerous unsafe financial obligations into a single, regular monthly settlement.

You may not intend to apply for a financial obligation consolidation loan if you can not control your costs. Having https://www.real-estate-key-largo.com/category/my-blog/ may maintain you from making any kind of brand-new settlements, and also the finance may encourage you to rack up even more financial obligation.

They will not influence your credit rating

Poor credit history finances are short term fundings designed to assist individuals with reduced credit scores get money. They use flexible terms as well as rates as well as can be an excellent method to combine financial obligation and also pay for emergencies. Nevertheless, negative credit scores fundings have a tendency to have greater interest rates than various other sorts of car loans.

Getting a car loan with a poor credit history can be difficult. To avoid high rate of interest, it is best to make payments on time and settle the equilibrium as rapidly as feasible. Paying for balances is one of the most reliable means to elevate a credit report.

Prior to obtaining a bad credit history loan, you must contrast offers as well as fees. Lending institution as well as local banks are good alternatives for a reduced rate. You can additionally try online lenders. These lending institutions have a much better understanding of how to handle negative debt as well as may be able to offer even more affordable terms.